Financial Planning for Studying Abroad

- Home

- Blog

Financial Planning for Studying Abroad

Financial Planning for Studying Abroad: A Guide for Indian Families

Embarking on the journey of international education is a dream for many Indian families, but it requires careful financial planning to turn this dream into reality. As costs for studying abroad can be substantial, it is crucial for families to start budgeting for study abroad well in advance. In this guide, we will delve into the intricacies of securing student loans and managing expenses related to international education costs, providing financial advice for students and their families. With expert study abroad tips, we aim to empower Indian families with the knowledge and confidence needed to support their children's global education aspirations. For personalized guidance and support, contact Shiksha Galore, your trusted advisor in navigating the path to studying in the UK, USA, Australia, New Zealand, or Canada.

Financial Planning for Studying Abroad

Budgeting for Study Abroad

Budgeting for study abroad is the cornerstone of effective financial planning. Start by researching the tuition fees, accommodation, travel costs, and daily living expenses in your chosen country. Countries like the UK, USA, Australia, New Zealand, and Canada have varying cost structures, so it's essential to gather detailed information. Once you have an estimate, create a comprehensive budget that includes all these elements. Consider opening a dedicated savings account to regularly deposit funds earmarked for education expenses. This helps in tracking your progress and ensures funds are available when needed. Additionally, explore scholarships and financial aid opportunities to reduce the financial burden. Be realistic yet flexible in your budget, accounting for fluctuations in currency exchange rates. Regularly review and adjust your plan to accommodate any changes. With disciplined budgeting, Indian families can better manage the financial demands of studying abroad, making the dream more attainable.

Managing Expenses Effectively

Managing expenses effectively is crucial for students studying abroad to prevent financial stress. Begin by prioritizing essential expenditures such as tuition, rent, and food. Use budgeting apps to monitor spending and ensure you stay within your limits. Opt for student discounts whenever available, as many countries offer reduced rates on public transport, cultural activities, and retail purchases. It's also wise to cook at home rather than dining out frequently, which can significantly cut costs. Another strategy is to share housing with other students to reduce accommodation expenses. Keep track of utilities and avoid unnecessary energy consumption to lower bills. Additionally, consider part-time work opportunities that not only provide extra income but also enhance your international experience. Regularly review your financial situation and adjust your spending habits as needed. By carefully managing expenses, Indian students can focus on their studies and enjoy their international education journey without financial worry.

Exploring Funding Options

Securing Student Loans

Securing student loans is a pivotal step for many Indian families aiming to support their child's international education. Start by researching different loan options from both public and private financial institutions. Compare their interest rates, repayment terms, and any additional fees. Government-backed loans often offer more favorable terms and should be considered first. Ensure you understand the eligibility criteria, which might include academic performance, admission to a recognized institution, and co-signer requirements. Once you've selected a suitable loan, prepare the necessary documentation, such as admission letters, identity proofs, and financial statements. Applying early can prevent delays and provide peace of mind. Be sure to read the fine print and clarify any doubts before signing the agreement. Remember, student loans are a long-term commitment, so it's crucial to have a solid repayment plan in place. This strategic approach can make international education more accessible and affordable for Indian families.

Scholarships and Grants

Scholarships and grants are excellent funding options that can significantly reduce the financial burden of studying abroad. Unlike loans, they do not require repayment, making them highly sought after by Indian students. Start by researching scholarships offered by universities, governments, and private organizations in your chosen study destination. Each scholarship will have specific eligibility criteria, such as academic merit, extracurricular achievements, or financial need. It's important to apply early and ensure all application requirements, including essays, recommendation letters, and transcripts, are meticulously completed. Additionally, grants are often available for research or specific fields of study, so exploring options within your academic discipline can be beneficial. Regularly check for new opportunities, as deadlines and criteria can change. By securing scholarships and grants, students can focus more on their studies and less on financial constraints, paving the way for a more enriching international education experience.

Preparing for International Education Costs

Financial Advice for Students

Sound financial advice is invaluable for students preparing to study abroad, ensuring they manage their funds wisely. Begin by establishing a clear understanding of your monthly budget, covering essential expenses such as accommodation, food, and transportation. Allocate a portion for unexpected costs to avoid financial surprises. Open a local bank account in the host country to facilitate easy access to funds and reduce transaction fees. It's also advantageous to familiarize yourself with the currency exchange rates and opt for cost-effective ways to transfer money internationally. Consider building a financial safety net by having savings that can cover at least three months of expenses. Additionally, develop a habit of tracking your spending to identify areas where you can cut back. Engaging in part-time work, if permissible, can also provide supplementary income and practical experience. With these financial strategies, students can maintain fiscal stability and focus on making the most of their international education.

Study Abroad Tips for Indian Families

For Indian families, preparing for the financial aspects of studying abroad involves several practical tips to ensure a smooth transition. Begin by creating a detailed financial plan that includes all potential expenses and sources of funding. It's essential to start this process early to give ample time for savings and adjustments. Engage with educational consultants or advisors who specialize in international education; they can provide insights into cost-effective strategies and potential financial aid opportunities. Encourage open communication within the family about budgeting, financial responsibilities, and expectations. This transparency helps in preemptively addressing any concerns or misunderstandings. Additionally, familiarize yourselves with the cultural and economic landscape of the host country to better anticipate lifestyle-related expenses. Emphasize the importance of financial discipline to your child, as it's crucial in managing their living costs abroad. By following these tips, Indian families can confidently support their children's global education endeavors while maintaining financial prudence.

Latest Blogs

-

-

Visa Application: Top Tips for a Smooth Journey!

17 Feb 2024 -

Studying Down Under Your Guide to the New Australian Student Visa Requirements

06 Apr 2024 -

Canadian Provincial Attestation Letter (PAL) Process: A Guide for International Students

13 Apr 2024 -

Advantages of Studying Abroad

08 May 2024 -

JKBOSE Class 10 Results 2024: The results for JKBOSE private and bi-annual students will be announce

11 Nov 2024 -

Study Engineering in New Zealand

13 Nov 2024 -

Canada's Implied Status Explained

14 Nov 2024 -

Study Abroad Made Easy in India

14 Nov 2024 -

January 2025 Intake at UK universities are open | Apply with Shiksha Glore

17 Nov 2024 -

Study Abroad Education Consultancy in Boisar | Shiksha Galore

23 Nov 2024 -

The Ultimate Guide for Indian Students Navigating the Study Abroad Journey with Shiksha Galore

06 Dec 2024 -

Top Visa Application Tips for Indian Students A Step-by-Step Guide to Studying in Australia, USA, an

09 Dec 2024 -

Comprehensive Strategies for Indian Students Studying Abroad

12 Dec 2024 -

Choosing the Right University Tips and Selection Criteria for Indian Students Abroad

13 Dec 2024 -

Master Your Indian Study Abroad Journey

16 Dec 2024 -

Mastering the IELTS: Essential Preparation Advice for Indian Students

17 Dec 2024 -

Shiksha Galore Guides Indian Students to Success in Australia, New Zealand, and Canada

20 Dec 2024 -

Cultural Adaptation and Job Prospects: A Comprehensive Study Abroad Guide for Indian Students

23 Dec 2024 -

Your Step by Step Guide to Studying Abroad with Shiksha Galore From Visa Application Tips to Free Co

26 Dec 2024 -

Step-by-Step Guide for International Students: How to Apply for USA Universities

30 Dec 2024 -

Discover Affordable & Quality Study Abroad Destinations for Indian Students

09 Jan 2025 -

.jpg)

Navigating the World of Study Abroad Scholarships

13 Jan 2025 -

Impact of Global Events on International Education

13 Jan 2025 -

Innovative Degree Programs Abroad

15 Jan 2025 -

Navigating Post-Study Work Opportunities

20 Jan 2025 -

Preparing Indian Students for University Life Abroad

21 Jan 2025 -

The Rise of Hybrid Learning

25 Jan 2025 -

Financial Planning for Studying Abroad

25 Jan 2025 -

Indian Alumni Thriving at Top Global Universities

25 Jan 2025 -

Understanding University Rankings

27 Jan 2025 -

Study Abroad 2025 A Quick Start Guide

05 Feb 2025 -

Ace Your IELTS for Study Abroad

06 Feb 2025 -

Top Scholarships for Indian Students

08 Feb 2025 -

Cost of Studying Overseas in 2025

10 Feb 2025 -

Visa Interview Prep Tips

12 Feb 2025 -

Study in the USA A Step-by-Step Guide

14 Feb 2025 -

Study in the UK Essential Guide

21 Feb 2025 -

Study in Canada Funding & Options

21 Feb 2025 -

Choosing the Right Overseas Consultant

21 Feb 2025 -

Undergrad Programs Abroad Overview

22 Feb 2025 -

Postgrad Abroad for Career Growth

24 Feb 2025 -

Education Loan Guide for Students

25 Feb 2025 -

Global Education Trends in 2025

28 Feb 2025 -

Top Canadian Universities for Fall 2025: Application Timelines and Key Deadlines

06 Mar 2025 -

A Guide to Studying in the USA for the 2025 Intake: Universities, Courses, and Scholarships

08 Mar 2025 -

Everything You Need to Know About Postgraduate Studies in the UK for the 2025 Academic Year

11 Mar 2025 -

Undergraduate Courses in Canada for the 2025 Intake: Choosing the Right Program

12 Mar 2025 -

Australian Universities’ Application Process for 2025: Step-by-Step for International Students

15 Mar 2025 -

Funding Your Masters in the USA: Scholarships and 2025 Admissions

17 Mar 2025 -

Transitioning to a Global Classroom: Canadian Campus Life for 2025 Entrants

19 Mar 2025 -

Bachelor’s Degree in Australia for 2025: Top Universities and Career Prospects

21 Mar 2025 -

Finding the Perfect University Fit in the UK: A Comprehensive 2025 Intake Guide

22 Mar 2025 -

Exploring STEM Programs in the USA for the 2025 Semester: Innovations & Opportunities

26 Mar 2025 -

How to Make Your Canadian University Application Stand Out for the 2025 Cycle

28 Mar 2025 -

Crucial Admission Tests for UK Universities in 2025: Tips and Best Preparation Resources

31 Mar 2025 -

Graduate Research Opportunities in Canada for 2025: What to Expect and How to Prepare

01 Apr 2025 -

How to Navigate Visa Requirements for the USA, UK, Canada, and Australia for 2025 Enrollments

03 Apr 2025 -

Overview of the September 2025 Intake for UK & Australia

10 Apr 2025 -

Top Reasons to Choose Australia for Fall/September 2025 Admissions

14 Apr 2025 -

UK vs. Australia: Comparing Tuition Fees & Living Costs for 2025

15 Apr 2025 -

Popular Undergraduate Programs in the UK for September 2025

17 Apr 2025 -

Exploring Master’s Degrees in Australia for the 2025 Intake

18 Apr 2025 -

Step-by-Step Guide to Securing Scholarships in the UK for 2025

19 Apr 2025 -

How to Write a Winning Statement of Purpose for Australian Universities

21 Apr 2025 -

Career Prospects After Completing Your Degree in Australia

22 Apr 2025 -

Top Universities in Australia for September 2025: Rankings & Highlights

23 Apr 2025 -

Balancing Work and Study: Part-Time Jobs in the UK for 2025 Students

24 Apr 2025 -

Scholarships & Grants in Australia: September 2025 Application Strategies

25 Apr 2025 -

Accommodation Options for UK Students: On-Campus & Off-Campus Insights

28 Apr 2025 -

How to Prepare for Australia’s International English Language Tests

29 Apr 2025 -

Managing Culture Shock: Transitioning into UK University Life

30 Apr 2025 -

Delving into Research-Based Degrees in the UK: Opportunities for 2025

02 May 2025 -

Post-Study Work Visas: Australia vs. UK After the 2025 Intake

03 May 2025 -

Practical Tips to Ace Online Interviews & Assessments for 2025 Admissions

05 May 2025 -

Are Study Abroad Expenses Tax-Deductible?

12 May 2025 -

How Study Abroad Changes You

14 May 2025 -

How Study Abroad Works: Process & Key Steps

16 May 2025 -

How Study Abroad Benefits Your Career & Education

20 May 2025 -

How to Study Abroad for Free

21 May 2025 -

Are Study Abroad Programs Competitive?

23 May 2025 -

Are Study Abroad Scholarships Taxable?

26 May 2025 -

Are Study Abroad Programs Worth It?

28 May 2025 -

Karnataka SSLC study abroad eligibility: A guide to scores and admission criteria abroad

23 Jul 2025 -

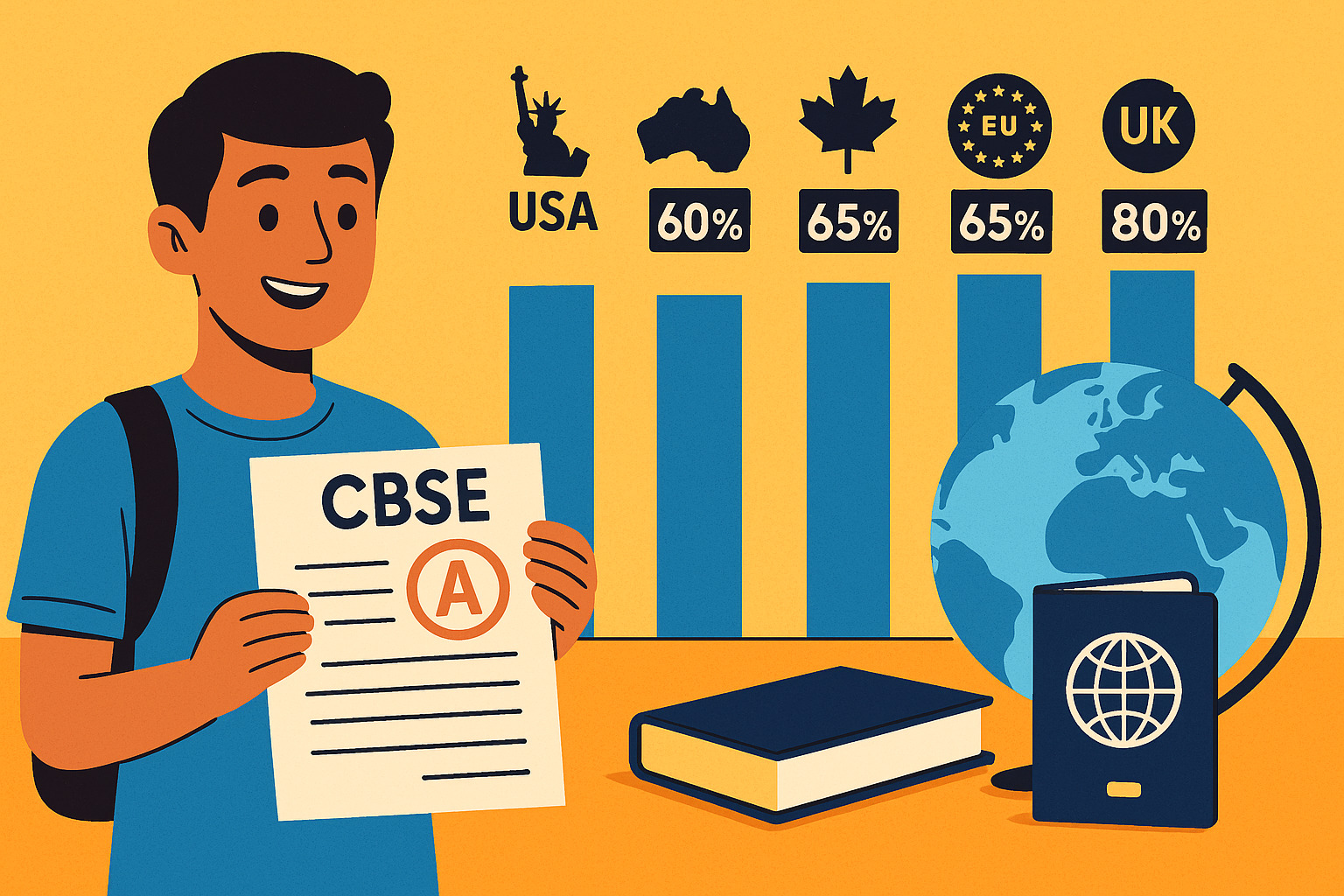

CBSE Study Abroad Eligibility: Guide to 2025 Compartment Results & Admission Percentages

30 Jul 2025 -

CBSE Study Abroad Eligibility: Your 2025 Compartment Results & Percentage Playbook

01 Aug 2025 -

2026 Study Abroad Strategy: Hyper-Personalized AI Guidance for Ambitious Students

07 Aug 2025 -

Study Abroad USA 2026: Berkeley • Chicago • Princeton—Your smartest route to impact

12 Aug 2025 -

Top 10 Cheapest Countries to Study Abroad for Indian Students in 2026

19 Aug 2025 -

Scholarships and Financial Aid in Affordable Study Destinations for Indian Students

19 Aug 2025 -

Budgeting & Money-Saving for Indian Students: The 2026 Master Guide

19 Aug 2025 -

Cheapest Countries to Study Abroad after 12th Undergraduate 2026 The Complete India-Focused Guide

21 Aug 2025 -

Cheapest Countries to Pursue a Master’s Degree for Indian Students 2026 The Definitive, India-Focuse

21 Aug 2025 -

Cost of Living Comparison in Top Affordable Countries 2026 A Practical, India-Focused Playbook

21 Aug 2025 -

Tuition-Free Education Abroad: Countries with No (or Minimal) Tuition Fees 2026

26 Aug 2025 -

Working Part-Time While Studying: Earning to Offset Costs for Indian Students 2026 Definitive Guide

26 Aug 2025 -

Hidden Costs of Studying Abroad and How Indian Students Can Manage Them

01 Sep 2025 -

Affordable Alternatives to Popular Expensive Countries for Indian Students 2026 Complete Guide

01 Sep 2025 -

High ROI (Return on Investment): Affordable Education That Pays Off for Indian Graduates

01 Sep 2025 -

Global Innovation Hubs 2026: Study Abroad Where Industries Are Built, Not Just Taught

11 Sep 2025 -

.jpg)

UK Graduate Route Visa Changes 2026 What Students Must Knowv

30 Sep 2025 -

Game-Changing Opportunity: University of Nottingham Removes Postgraduate Application Fees!

17 Oct 2025 -

University of Nottingham Removes Postgraduate Application Fees 2025

27 Oct 2025 -

Best Country to Study Abroad in 2026 for Indian Students

31 Dec 2025