Budgeting & Money-Saving for Indian Students: The 2026 Master Guide

If you’re planning an overseas degree, Budgeting and Money-Saving Strategies for Indian Students Studying Abroad should be your very first chapter—not the last-minute appendix. Tuition is only one line item. The real game is total cost of attendance: tuition + living + the Hidden Costs of Studying Abroad (and How Indian Students Can Manage Them) ? scholarships ? part-time earnings. In this long-form, parent-friendly guide (built to support the pillar Top 10 Cheapest Countries to Study Abroad for Indian Students in 2026), we’ll hand you a complete financial playbook—covering scholarship stacking, weekly spending habits, country-by-country cost patterns, and how to turn your degree into High ROI (Return on Investment): Affordable Education That Pays Off for Indian Graduates.

We’ll also thread in the cluster topics you asked for—Cheapest Countries to Study Abroad after 12th (Undergraduate) [2026], Cheapest Countries to Pursue a Master’s Degree for Indian Students [2026], Cost of Living Comparison in Top Affordable Countries (2026), Tuition-Free Education Abroad: Countries with No (or Minimal) Tuition Fees [2026], Working Part-Time While Studying: Earning to Offset Costs for Indian Students, and Affordable Alternatives to Popular Expensive Countries for Indian Students—so every decision is financially precise.

1) The Golden Equation: How to Think About Affordability

Total Cost = Tuition + Living + Hidden Costs ? Scholarships ? Part-Time Income ? Fee Waivers

Memorise this and you’ll never be misled by a low sticker price. The most successful families follow these five rules:

- Country fit first, city fit second. In the Cost of Living Comparison in Top Affordable Countries (2026), a Tier-2 university city can be ?2–5 lakh/year cheaper than a capital.

- Program ROI beats brand. A lesser-known program with paid co-ops can beat a famous name with no funding—classic High ROI logic.

- Scholarship stacking wins. Combine merit waivers + regional grants + lab work + housing discounts; don’t rely on one big award.

- Document early. Income proofs and transcripts drive need-based cuts in countries like Italy and parts of Portugal/France.

- Work that builds skills. Working Part-Time While Studying: Earning to Offset Costs for Indian Students should double as portfolio-building, not just pocket money.

2) A Simple, Powerful Budget Framework (The 50/30/20 for Students)

For Budgeting and Money-Saving Strategies for Indian Students Studying Abroad, use this split after scholarships:

- 50% Needs: rent, food, utilities, local transport, insurance, phone.

- 30% Study & Career: books, software, lab/studio supplies, conferences, certification fees, interview travel, portfolio hosting.

- 20% Buffer & Goals: emergency fund, flight savings, visa renewals, deposits, short trips.

Revisit monthly. When part-time income rises, top up the emergency fund first, then accelerate certification or conference spending (that’s ROI-positive).

3) Country Costs at a Glance (Indicative Ranges)

These ranges are purposely conservative and align with our pillar on the Top 10 Cheapest Countries to Study Abroad for Indian Students in 2026. Actuals vary by course and lifestyle.

| Country (city type) | Annual Tuition (public, typical) | Annual Living (student city) | Money notes |

|---|---|---|---|

| Germany | €0–€3,000 | €9,600–€12,000 | Tuition-Free Education Abroad: Countries with No (or Minimal) Tuition Fees [2026]—semester contribution applies. |

| France | Low–Mid | €9,000–€13,000 | Heavy student discounts on meals/transport. |

| Italy | €1,000–€4,000 (income-linked) | €7,000–€10,000 | Regional grants can drop net cost sharply. |

| Spain | €1,000–€6,000 | €7,000–€10,000 | Cheaper outside Madrid/Barcelona. |

| Poland | €2,000–€5,000 | €4,500–€7,000 | Strong value in CS/IT, FinTech, Mechatronics. |

| Czechia | €2,500–€7,000 | €5,500–€8,500 | Brno cheaper than Prague; research-active. |

| Hungary | €2,500–€6,000 | €5,000–€8,000 | National scholarships at scale. |

| Portugal | €2,000–€5,000 | €6,000–€9,000 | Great for software, marine sciences, renewables. |

| Malaysia | Moderate | MYR 18,000–30,000 | UK/AU branch-campus credits at local cost. |

| Taiwan | Moderate | Modest | Merit scholarships + stipends; STEM heavy. |

This table underpins the Cost of Living Comparison in Top Affordable Countries (2026) section of your plan.

4) Budgeting and Money-Saving Strategies for Indian Students Studying Abroad (Core Tactics)

A) Cut Fixed Costs First (Rent, Food, Transport)

- Live one stop away. Instead of the city centre, pick a suburb on a direct tram/metro line. A 20-minute commute can save ?1–2 lakh/year.

- Residence halls for Year-1. Predictable bills, furnished rooms, and built-in networks. Shift to shared apartments in Year-2 once you know the market.

- Cook 70–80% of meals. Batch-cook on weekends; build a 10-recipe rotation (dal-rice, khichdi, pasta sauce base, stir-fry, overnight oats).

- Student passes. Buy the semester transport pass on day one; log every ride for the first month to prove value.

- Energy savings. In colder countries, seal windows, use draft stoppers, and layer clothes—small steps shave utility bills.

B) Make Income Predictable (Without Breaking Academics)

- On-campus first. Library desk, lab assistant, IT help, peer tutor—safer hours, better references.

- Align work to major. Design studio monitor, coding tutor, content creator for a research centre—your job becomes your portfolio.

- Vacation internships. Treat summer/winter as earning seasons: 8–10 weeks can cover a big chunk of rent.

- Freelance ethically. Only where permitted; register correctly. Focus on work you can showcase (UI mockups, code repos, data dashboards).

- Time blocks. Two weekday micro-shifts + one weekend block keeps study rhythm intact.

This is how Working Part-Time While Studying: Earning to Offset Costs for Indian Students turns from “side cash” into “career accelerator.”

C) Buy Smart, Buy Once

- Second-hand everything. Facebook groups, university marketplaces, charity stores: beddings, pans, winter coats, cycles.

- Student software. Many suites are free or steeply discounted—grab them before you pay retail.

- Phone plans. Pick student SIMs with campus-Wi-Fi reliance; avoid long-term lock-ins.

- Banking & remittance. Compare forex cards vs local bank accounts; keep ATM fees, mark-ups, and spreads in check.

D) Protect the Downside

- Emergency buffer. 50k–1 lakh equivalent parked for health/visa/flight surprises.

- Insurance literacy. Learn claim basics early; keep receipts; know your co-pay/deductibles.

- Academic priority. One backlog can cost more than a month’s earnings—timetable part-time work accordingly.

5) Hidden Costs of Studying Abroad (and How Indian Students Can Manage Them)

This cluster topic is a budget-killer if ignored. Build them into Month-0:

- Residence deposits (1–3 months). Ask for a deposit plan or a cheaper room for the first term.

- Health insurance & co-pays. Mandatory in most systems; know the plan and upload documents early.

- Visa/residence permit fees (plus renewals).

- Course materials. Lab coats, studio supplies, software licenses.

- First-month setup. Utensils, bedsheets, transit passes, SIMs.

- Banking charges. International transfer spread + ATM fees.

How to manage: - Arrive with a starter kit budget; buy second-hand; anchor purchases to a list; avoid impulse electronics; share rarely-used items (drill, printer, mixer).

6) Scholarships and Financial Aid in Affordable Study Destinations for Indian Students

Scholarships convert a “manageable” plan into an “easy” one. Build a stack:

- Merit waivers tied to your Class-12/UG % and SAT/IELTS/TOEFL.

- Need-based fee reductions (Italy/Portugal/parts of France) using family income proofs.

- University excellence scholarships for top entrants.

- Government or agency awards prioritising STEM, sustainability, and bilateral ties.

- RA/TA and lab jobs once on campus.

- Housing bursaries and meal subsidies.

Submit 4–5 targeted applications per student, not 1–2 generic tries. This is the fastest lever inside Budgeting and Money-Saving Strategies for Indian Students Studying Abroad.

7) Tuition-Free Education Abroad: Countries with No (or Minimal) Tuition Fees [2026]

- Germany is the headliner for public universities with no or minimal tuition (semester contributions apply).

- Income-linked systems in Italy and parts of Portugal/France can take you close to zero net tuition with documents in order.

- Scholarship-heavy ecosystems in Taiwan/Hungary can offset most tuition even when a sticker price exists.

Always pair this with realistic living-cost choices from the Cost of Living Comparison in Top Affordable Countries (2026).

8) Cheapest Countries to Study Abroad after 12th (Undergraduate) [2026]

UG budgets must emphasise safety, English-taught breadth, and community:

- Germany (public + foundation routes), Poland, Hungary, Spain, Italy, Portugal, Czechia, Malaysia, France (public), Taiwan (STEM-heavy).

- Prioritise residence halls, meal plans, and campus jobs to stabilise first-year costs.

- Use a city shortlist: e.g., Bologna/Padua/Turin (Italy), Valencia/Granada (Spain), Brno (Czechia), Gda?sk/Wroc?aw (Poland).

9) Cheapest Countries to Pursue a Master’s Degree for Indian Students [2026]

Master’s budgets hinge on research income:

- Germany: public tuition minimal; RA roles common.

- France/Czechia/Portugal: research stipends + lower city costs (outside capitals).

- Italy/Spain: fee waivers + regional grants + growing AI/analytics tracks.

- Taiwan: stipend-based STEM scholarships with strong labs.

This is where High ROI (Return on Investment): Affordable Education That Pays Off for Indian Graduates truly shines.

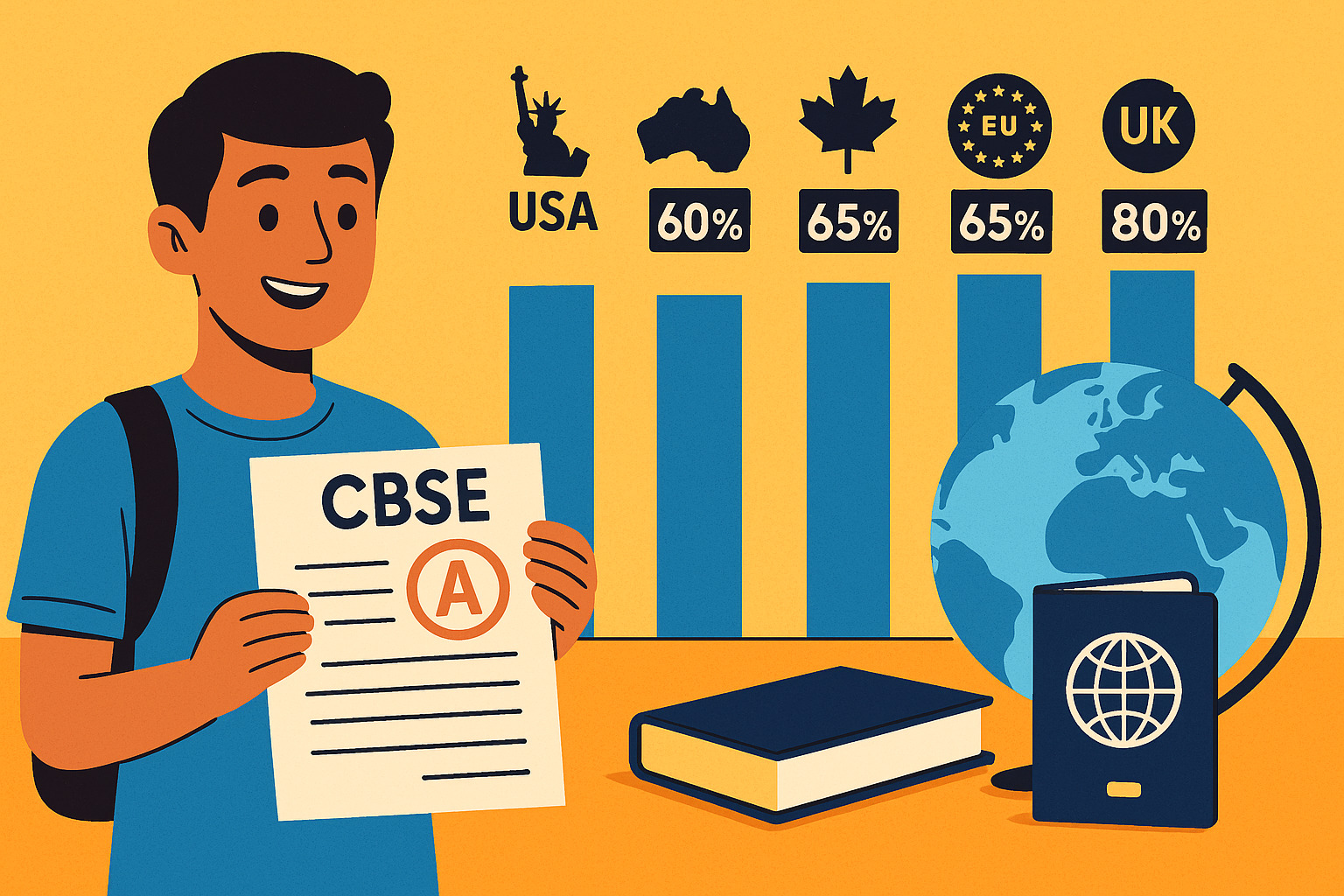

10) Affordable Alternatives to Popular Expensive Countries for Indian Students

- Instead of USA for CS/data: Poland, Czechia, Portugal—English programs + modern labs.

- Instead of UK for business/design: Italy, Spain, Hungary—lower tuition, robust creative ecosystems.

- Instead of Canada/Australia for hospitality/cybersecurity: Malaysia—branch-campus routes and co-ops at a fraction of the cost.

These swaps protect budgets without sacrificing internships or post-study outcomes.

11) ROI Thinking: Turn Rupees Spent into Payback Months

To anchor Budgeting and Money-Saving Strategies for Indian Students Studying Abroad, estimate payback time:

- Total investment = (Tuition + living + hidden costs) ? (scholarships + part-time income).

- Expected starting salary in your destination/sector.

- Payback months = Total investment ÷ monthly net salary.

Prioritise degrees that bring payback within 12–36 months, a realistic range in the affordable destinations above—especially for engineers, data/AI practitioners, designers with portfolios, and hospitality leaders.

12) The Month-0 to Month-12 Money Roadmap (Step-by-Step)

Month-0 (Pre-departure)

- Fix country/city via the Cost of Living Comparison in Top Affordable Countries (2026).

- Freeze a starter kit list (bedding, cookware, SIM, transit pass).

- Pay deposits, buy a used laptop if required, keep receipts.

Month-1

- Open local bank account; activate student transport; cook 70% meals; find campus job boards.

- Track every expense for 30 days—this baseline powers your budget.

Month-2 to Month-3

- Lock 1–2 on-campus shifts; line up micro-internships for breaks.

- Join student marketplaces; buy second-hand winter gear.

Month-4 to Month-6

- Apply for summer internships; plan travel off-peak.

- Negotiate rent renewal 60 days before due date.

Month-7 to Month-12

- Convert capstone to paid RA/TA; add a certification (Cloud, Python, Figma, GA4).

- Re-benchmark spending; move house if needed to cut 10–15%.

Cycle repeats in Year-2, but your fixed costs should be lower and your income higher.

13) Ready-to-Use Budget Templates

Monthly Essentials (student city)

- Rent (shared): …

- Utilities & Wi-Fi: …

- Groceries: …

- Transport pass: …

- Phone: …

- Insurance: …

- Study costs (books/software): …

- Buffer (5–10%): …

One-Time / Irregular

- Visa/permit + renewals, flight home, laptop, conference fees, certification, deposits.

Income Plan

- On-campus hours × rate = …

- Vacation internship weeks × stipend = …

- RA/TA (if applicable) = …

Populate these before you travel; update them every semester.

14) Micro-Habits That Save Big

- The 24-hour rule: wait a day on non-essential buys.

- Two-plate kitchen: one big pan + one pot handles 80% of meals.

- Lunchbox routine: carry one daily; saves ?10–15k/month equivalent.

- Library > café: quiet + free Wi-Fi + printing quotas.

- Skill-for-skill barters: exchange your coding/design for a friend’s photography/notes.

These tiny behaviours compound faster than any one-time discount code.

15) Red Flags That Blow Budgets

- Signing the first apartment you see (hidden mould, overpriced utilities).

- Ignoring tenancy clauses (exit fees).

- Paying retail for laptops/phones without student discounts.

- Under-insuring health or skipping contents insurance in shared flats.

- Overloading part-time hours in mid-term—grades slip, ROI collapses.

16) Put It All Together: A Sample “Stacked” Plan

- Country/City: Spain (Valencia)

- Program: BSc Data & AI (English-taught)

- Scholarship stack: Entrance merit 20% + city housing grant + two lab monitor shifts/weekly

- Budget levers: Shared flat near metro (20-min), semester pass, 80% home-cooked

- Career moves: Kaggle projects, volunteering as data tutor, summer internship in logistics analytics

- Expected payback: 18–30 months post-grad (sector dependent)

This exact thinking is repeatable in Germany (public), Italy (income-linked), Poland/Czechia/Hungary (low tuition), Portugal (software), Malaysia (branch campuses), and Taiwan (STEM stipends).

17) Quick FAQ for Parents

Can my child study in English in non-English countries?

Yes—especially at master’s level. Many UG programs are English-taught too.

Is part-time work enough to cover everything?

Treat it as offset, not full funding. The right campus role can cover 25–60% of living costs without hurting grades.

What if we don’t get a big scholarship?

Stack smaller waivers + city discounts + RA/TA + cheap housing. A layered plan usually beats one “mega” award that never arrives.

18) Why Work with Shiksha Galore

Our counselling starts with Budgeting and Money-Saving Strategies for Indian Students Studying Abroad—not afterthoughts. We’ll:

- Map you to the Top 10 Cheapest Countries to Study Abroad for Indian Students in 2026 that truly fit your goals.

- Build a scholarship portfolio: 1 flagship + 2 university waivers + 1 external + RA/TA plan.

- Provide city-wise Cost of Living Comparison in Top Affordable Countries (2026) sheets.

- Coach you for Working Part-Time While Studying roles that grow your portfolio.

- Pre-departure “Hidden Costs” checklist so there are zero surprises.

+91 8645 666 195 | info@shikshagalore.com | shikshagalore.com

Office No. 4 & 5, Building No.7, Mira Thakur Galaxy, Yashwant Shrusti Rd, Sanjay Nagar, Boisar, Khaira, Maharashtra 401501, India

19) One Last Time—Your Money Checklist (Printable)

- Country + city chosen via cost-of-living matrix

- Scholarship stack submitted (4–5 applications)

- Residence hall confirmed for Year-1

- Emergency fund set aside

- Student transport + SIM + bank set up Week-1

- Meal plan and grocery staples sorted

- On-campus job hunt started Week-2

- Summer internship targets identified by Month-3

- Budget reviewed monthly; rent re-negotiation plan ready 60 days before renewal

Master these Budgeting and Money-Saving Strategies for Indian Students Studying Abroad and your 2026 journey won’t just be affordable—it will be strategic, sustainable, and high-return.

.jpg)

.jpg)