Are Study Abroad Expenses Tax-Deductible?

- Home

- Blog

Are Study Abroad Expenses Tax-Deductible?

Are Study Abroad Expenses Tax-Deductible? A Complete Guide by Shiksha Galore

Are you planning to pursue your education overseas and wondering, "Are study abroad expenses tax-deductible?" You're not alone! Many Indian students and their families ask the same question when budgeting for international education. In this blog, Shiksha Galore, your trusted education consultancy in India, provides an in-depth look into tax deductions, what qualifies, and how you can plan your finances better while studying abroad.

Understanding Study Abroad Expenses: What Do They Include?

Before we dive into whether study abroad expenses are tax-deductible, let’s define what constitutes these expenses.

Study abroad expenses typically include:

- Tuition and academic fees

- Books and supplies

- Travel and visa fees

- Accommodation and living costs

- Health insurance

- Study material and technology

Each of these expenses plays a crucial role in your international education journey. However, not all of them are eligible for tax deductions under Indian or foreign tax laws.

Are Study Abroad Expenses Tax-Deductible in India?

The short answer: Yes, some study abroad expenses can be tax-deductible, but under certain conditions.

Under Section 80E of the Indian Income Tax Act, interest paid on an education loan for higher studies (in India or abroad) is eligible for tax deduction. This includes:

- Loans taken from financial institutions or approved charitable institutions

- Loans used to fund full-time studies for yourself, your spouse, children, or a legal ward

So while tuition fees and living costs themselves are not tax deductible, the interest paid on the education loan used to cover study abroad expenses is.

Tax Deductions: What Qualifies Under Section 80E?

To qualify for tax deductions under Section 80E:

- The loan must be taken specifically for higher education.

- Only the interest portion (not the principal) of the EMI qualifies.

- The deduction is available for a maximum of 8 years or until the interest is fully paid, whichever is earlier.

This is an excellent financial relief for families investing heavily in study abroad expenses.

Are Study Abroad Expenses Tax-Deductible in Foreign Countries?

If you're heading to countries like the USA, UK, or Canada, tax laws vary:

- USA: Certain education-related expenses can qualify for tax credits (like the American Opportunity Credit or Lifetime Learning Credit). International students on F-1 visas may have limited eligibility.

- Canada: Tuition tax credits are available for both domestic and some international students.

- UK and Australia: Typically, study expenses aren’t tax deductible, but students may be eligible for scholarships, bursaries, or financial aid.

Understanding the host country’s tax policies is essential. At Shiksha Galore, we guide students through these regulations.

Shiksha Galore’s Tips to Maximize Your Tax Deductions on Study Abroad Expenses

As a leading education consultancy, Shiksha Galore recommends the following tips:

- Maintain detailed records of your education loan, tuition, and related documents.

- File income tax returns on time to claim eligible tax deductions.

- Consult a tax advisor or let Shiksha Galore connect you with professionals who understand education-related tax laws.

Common Myths About Study Abroad Expenses and Tax Deductibility

Let’s clear the air:

- Myth 1: "All expenses for studying abroad are tax-deductible."

- Fact: Only education loan interest is eligible under Indian law.

- Myth 2: "You can claim deductions even without a loan."

- Fact: Section 80E strictly applies to loans.

- Myth 3: "Foreign tax benefits automatically apply to international students."

- Fact: Each country has different rules, and you may need a local taxpayer status.

How Shiksha Galore Helps You Navigate Study Abroad Expenses

Navigating study abroad expenses and tax laws can be overwhelming. That’s where Shiksha Galore comes in. We don’t just help you choose the right university or course; we provide full-spectrum consultancy including:

- Financial planning for overseas education

- Guidance on education loans and repayment

- Clarifying tax deductible benefits in India and abroad

- Document preparation and filing support

Real Stories: How Our Clients Benefited from Tax Deductions

Several of our clients have successfully claimed tax deductions on their education loans after studying abroad. For instance:

Ritika from Mumbai, who studied in Canada, saved significantly on her taxes by claiming the interest paid on her loan under Section 80E.

Amit from Pune, studying in the USA, received guidance from Shiksha Galore about U.S. tax credit eligibility, helping him plan his finances efficiently.

Final Thoughts: Are Study Abroad Expenses Tax-Deductible?

To wrap up: while study abroad expenses like tuition and lodging are not directly tax deductible in India, loan interest under Section 80E offers valuable tax deductions.

The key is strategic planning, correct documentation, and professional support. That’s what Shiksha Galore delivers with excellence.

Ready to Study Abroad? Let Shiksha Galore Help You Maximize Your Tax Deductions

Get free expert advice on how to finance your international education and make the most of eligible tax deductions. Contact Shiksha Galore today!

? Call Us: +91 8010722713

? Email Us: info@shikshagalore.com

???? Visit Us: Office No. 4 & 5, Building No.7, Mira Thakur Galaxy, Yashwant Shrusti Rd, Sanjay Nagar, Boisar, Khaira, Maharashtra 401501, India

???? Fill Out Our Form for Free Consultancy: Click here

Partner with Shiksha Galore to turn your dream of studying abroad into a smart, financially sound reality. Your future awaits!

Latest Blogs

-

-

Visa Application: Top Tips for a Smooth Journey!

17 Feb 2024 -

Studying Down Under Your Guide to the New Australian Student Visa Requirements

06 Apr 2024 -

Canadian Provincial Attestation Letter (PAL) Process: A Guide for International Students

13 Apr 2024 -

Advantages of Studying Abroad

08 May 2024 -

JKBOSE Class 10 Results 2024: The results for JKBOSE private and bi-annual students will be announce

11 Nov 2024 -

Study Engineering in New Zealand

13 Nov 2024 -

Canada's Implied Status Explained

14 Nov 2024 -

Study Abroad Made Easy in India

14 Nov 2024 -

January 2025 Intake at UK universities are open | Apply with Shiksha Glore

17 Nov 2024 -

Study Abroad Education Consultancy in Boisar | Shiksha Galore

23 Nov 2024 -

The Ultimate Guide for Indian Students Navigating the Study Abroad Journey with Shiksha Galore

06 Dec 2024 -

Top Visa Application Tips for Indian Students A Step-by-Step Guide to Studying in Australia, USA, an

09 Dec 2024 -

Comprehensive Strategies for Indian Students Studying Abroad

12 Dec 2024 -

Choosing the Right University Tips and Selection Criteria for Indian Students Abroad

13 Dec 2024 -

Master Your Indian Study Abroad Journey

16 Dec 2024 -

Mastering the IELTS: Essential Preparation Advice for Indian Students

17 Dec 2024 -

Shiksha Galore Guides Indian Students to Success in Australia, New Zealand, and Canada

20 Dec 2024 -

Cultural Adaptation and Job Prospects: A Comprehensive Study Abroad Guide for Indian Students

23 Dec 2024 -

Your Step by Step Guide to Studying Abroad with Shiksha Galore From Visa Application Tips to Free Co

26 Dec 2024 -

Step-by-Step Guide for International Students: How to Apply for USA Universities

30 Dec 2024 -

Discover Affordable & Quality Study Abroad Destinations for Indian Students

09 Jan 2025 -

.jpg)

Navigating the World of Study Abroad Scholarships

13 Jan 2025 -

Impact of Global Events on International Education

13 Jan 2025 -

Innovative Degree Programs Abroad

15 Jan 2025 -

Navigating Post-Study Work Opportunities

20 Jan 2025 -

Preparing Indian Students for University Life Abroad

21 Jan 2025 -

The Rise of Hybrid Learning

25 Jan 2025 -

Financial Planning for Studying Abroad

25 Jan 2025 -

Indian Alumni Thriving at Top Global Universities

25 Jan 2025 -

Understanding University Rankings

27 Jan 2025 -

Study Abroad 2025 A Quick Start Guide

05 Feb 2025 -

Ace Your IELTS for Study Abroad

06 Feb 2025 -

Top Scholarships for Indian Students

08 Feb 2025 -

Cost of Studying Overseas in 2025

10 Feb 2025 -

Visa Interview Prep Tips

12 Feb 2025 -

Study in the USA A Step-by-Step Guide

14 Feb 2025 -

Study in the UK Essential Guide

21 Feb 2025 -

Study in Canada Funding & Options

21 Feb 2025 -

Choosing the Right Overseas Consultant

21 Feb 2025 -

Undergrad Programs Abroad Overview

22 Feb 2025 -

Postgrad Abroad for Career Growth

24 Feb 2025 -

Education Loan Guide for Students

25 Feb 2025 -

Global Education Trends in 2025

28 Feb 2025 -

Top Canadian Universities for Fall 2025: Application Timelines and Key Deadlines

06 Mar 2025 -

A Guide to Studying in the USA for the 2025 Intake: Universities, Courses, and Scholarships

08 Mar 2025 -

Everything You Need to Know About Postgraduate Studies in the UK for the 2025 Academic Year

11 Mar 2025 -

Undergraduate Courses in Canada for the 2025 Intake: Choosing the Right Program

12 Mar 2025 -

Australian Universities’ Application Process for 2025: Step-by-Step for International Students

15 Mar 2025 -

Funding Your Masters in the USA: Scholarships and 2025 Admissions

17 Mar 2025 -

Transitioning to a Global Classroom: Canadian Campus Life for 2025 Entrants

19 Mar 2025 -

Bachelor’s Degree in Australia for 2025: Top Universities and Career Prospects

21 Mar 2025 -

Finding the Perfect University Fit in the UK: A Comprehensive 2025 Intake Guide

22 Mar 2025 -

Exploring STEM Programs in the USA for the 2025 Semester: Innovations & Opportunities

26 Mar 2025 -

How to Make Your Canadian University Application Stand Out for the 2025 Cycle

28 Mar 2025 -

Crucial Admission Tests for UK Universities in 2025: Tips and Best Preparation Resources

31 Mar 2025 -

Graduate Research Opportunities in Canada for 2025: What to Expect and How to Prepare

01 Apr 2025 -

How to Navigate Visa Requirements for the USA, UK, Canada, and Australia for 2025 Enrollments

03 Apr 2025 -

Overview of the September 2025 Intake for UK & Australia

10 Apr 2025 -

Top Reasons to Choose Australia for Fall/September 2025 Admissions

14 Apr 2025 -

UK vs. Australia: Comparing Tuition Fees & Living Costs for 2025

15 Apr 2025 -

Popular Undergraduate Programs in the UK for September 2025

17 Apr 2025 -

Exploring Master’s Degrees in Australia for the 2025 Intake

18 Apr 2025 -

Step-by-Step Guide to Securing Scholarships in the UK for 2025

19 Apr 2025 -

How to Write a Winning Statement of Purpose for Australian Universities

21 Apr 2025 -

Career Prospects After Completing Your Degree in Australia

22 Apr 2025 -

Top Universities in Australia for September 2025: Rankings & Highlights

23 Apr 2025 -

Balancing Work and Study: Part-Time Jobs in the UK for 2025 Students

24 Apr 2025 -

Scholarships & Grants in Australia: September 2025 Application Strategies

25 Apr 2025 -

Accommodation Options for UK Students: On-Campus & Off-Campus Insights

28 Apr 2025 -

How to Prepare for Australia’s International English Language Tests

29 Apr 2025 -

Managing Culture Shock: Transitioning into UK University Life

30 Apr 2025 -

Delving into Research-Based Degrees in the UK: Opportunities for 2025

02 May 2025 -

Post-Study Work Visas: Australia vs. UK After the 2025 Intake

03 May 2025 -

Practical Tips to Ace Online Interviews & Assessments for 2025 Admissions

05 May 2025 -

Are Study Abroad Expenses Tax-Deductible?

12 May 2025 -

How Study Abroad Changes You

14 May 2025 -

How Study Abroad Works: Process & Key Steps

16 May 2025 -

How Study Abroad Benefits Your Career & Education

20 May 2025 -

How to Study Abroad for Free

21 May 2025 -

Are Study Abroad Programs Competitive?

23 May 2025 -

Are Study Abroad Scholarships Taxable?

26 May 2025 -

Are Study Abroad Programs Worth It?

28 May 2025 -

Karnataka SSLC study abroad eligibility: A guide to scores and admission criteria abroad

23 Jul 2025 -

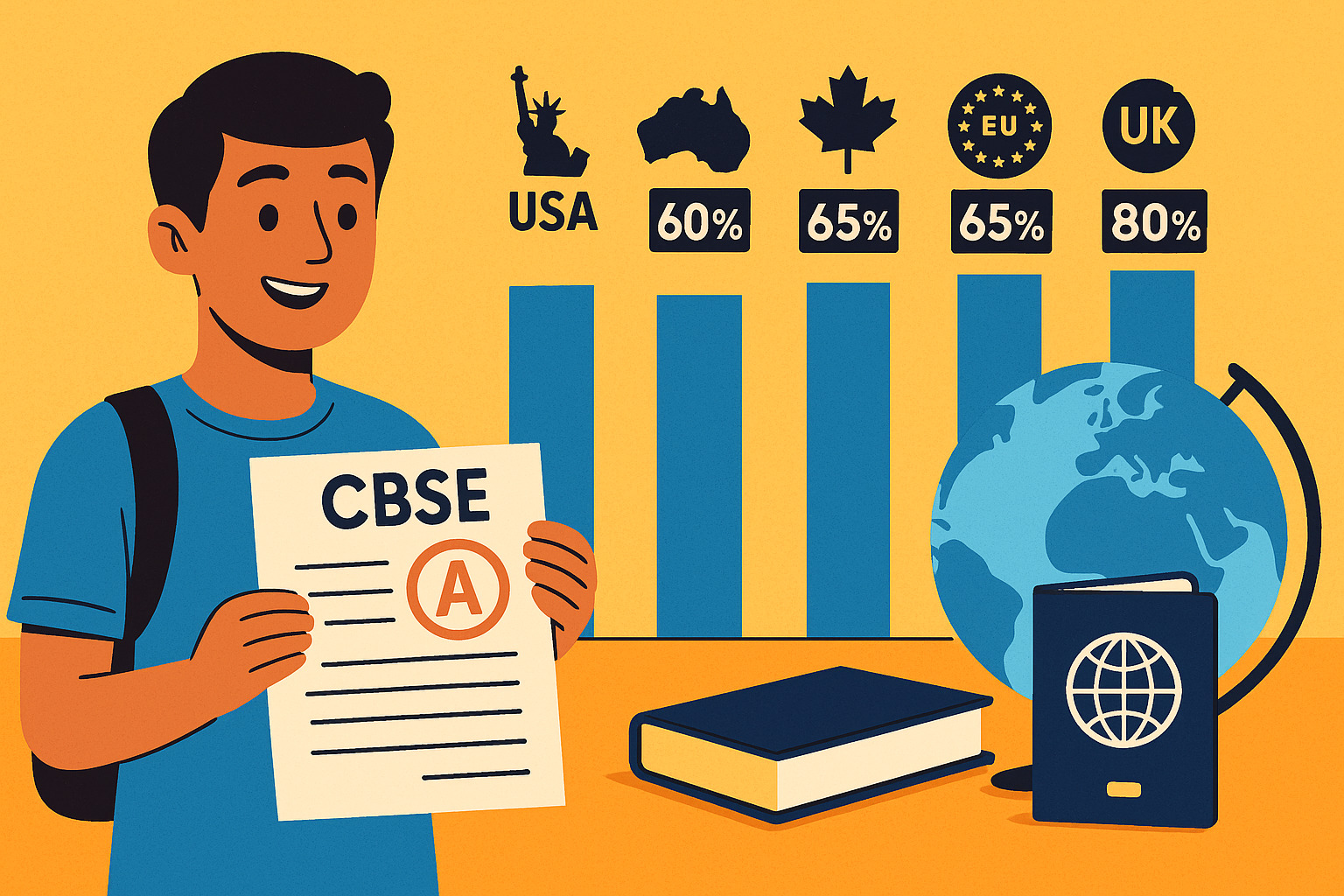

CBSE Study Abroad Eligibility: Guide to 2025 Compartment Results & Admission Percentages

30 Jul 2025 -

CBSE Study Abroad Eligibility: Your 2025 Compartment Results & Percentage Playbook

01 Aug 2025 -

2026 Study Abroad Strategy: Hyper-Personalized AI Guidance for Ambitious Students

07 Aug 2025 -

Study Abroad USA 2026: Berkeley • Chicago • Princeton—Your smartest route to impact

12 Aug 2025 -

Top 10 Cheapest Countries to Study Abroad for Indian Students in 2026

19 Aug 2025 -

Scholarships and Financial Aid in Affordable Study Destinations for Indian Students

19 Aug 2025 -

Budgeting & Money-Saving for Indian Students: The 2026 Master Guide

19 Aug 2025 -

Cheapest Countries to Study Abroad after 12th Undergraduate 2026 The Complete India-Focused Guide

21 Aug 2025 -

Cheapest Countries to Pursue a Master’s Degree for Indian Students 2026 The Definitive, India-Focuse

21 Aug 2025 -

Cost of Living Comparison in Top Affordable Countries 2026 A Practical, India-Focused Playbook

21 Aug 2025 -

Tuition-Free Education Abroad: Countries with No (or Minimal) Tuition Fees 2026

26 Aug 2025 -

Working Part-Time While Studying: Earning to Offset Costs for Indian Students 2026 Definitive Guide

26 Aug 2025 -

Hidden Costs of Studying Abroad and How Indian Students Can Manage Them

01 Sep 2025 -

Affordable Alternatives to Popular Expensive Countries for Indian Students 2026 Complete Guide

01 Sep 2025 -

High ROI (Return on Investment): Affordable Education That Pays Off for Indian Graduates

01 Sep 2025 -

Global Innovation Hubs 2026: Study Abroad Where Industries Are Built, Not Just Taught

11 Sep 2025 -

.jpg)

UK Graduate Route Visa Changes 2026 What Students Must Knowv

30 Sep 2025 -

Game-Changing Opportunity: University of Nottingham Removes Postgraduate Application Fees!

17 Oct 2025 -

University of Nottingham Removes Postgraduate Application Fees 2025

27 Oct 2025 -

Best Country to Study Abroad in 2026 for Indian Students

31 Dec 2025